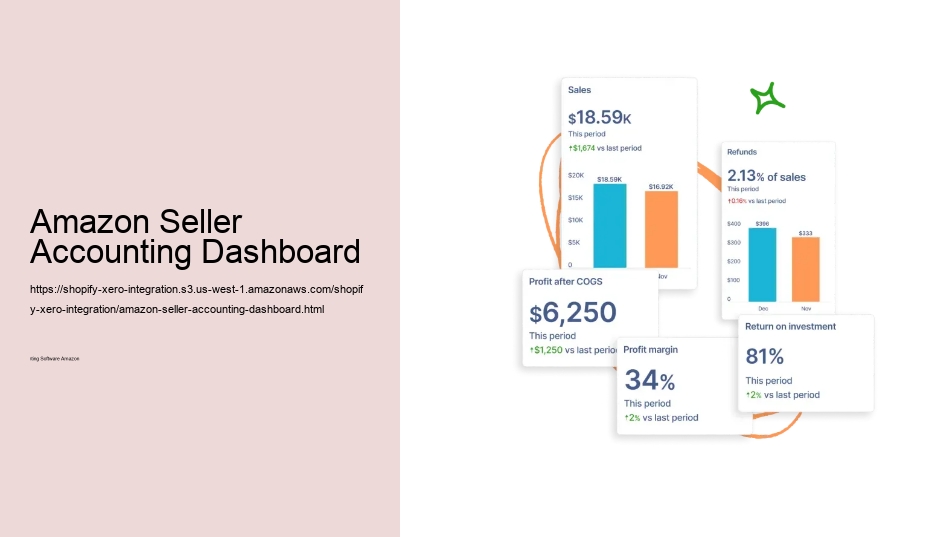

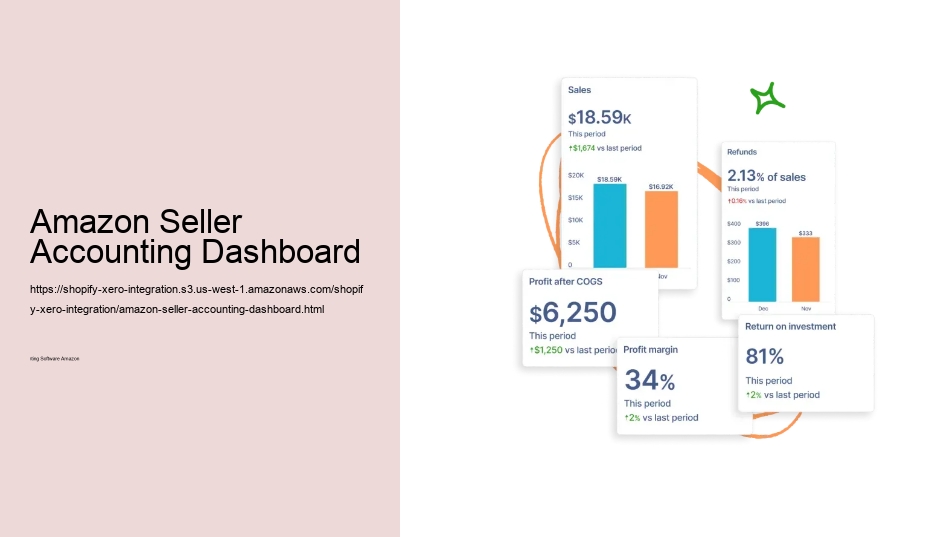

Automation reduces the need for frequent accountant consultations during tax season by maintaining regular and accurate books throughout the year. With dedicated support from Xero and QuickBooks teams, sellers can customize reports to gain insights into specific areas such as profitability analysis, sales trends, expense tracking, etc., helping them make informed business decisions. Are you a solo entrepreneur handling a modest volume of transactions, or do you manage a larger enterprise with complex inventory needs? One of its standout features is the real-time dashboard which provides up-to-date financial insights. Choosing the right accounting software equipped with specialized tools like Link My Books can transform an otherwise daunting task into a manageable one.

Whether it's expanding product lines or exploring new marketplaces, entrepreneurs have more time to plan and execute growth strategies rather than getting bogged down by back-office operations. Managing these elements requires a detailed approach to ensure accuracy in bookkeeping and compliance with tax laws. By integrating QuickBooks with tools like Link My Books, sellers can automate the transfer of transaction information directly into their accounting records. Xero and QuickBooks, when integrated with Link My Books, offer a seamless solution to this challenge.

A Deep Dive into Xero Features Tailored for Amazon SellersSimplifying Amazon Accounting with Xero and Link My BooksXero, in tandem with Link My Books, offers a seamless solution for Amazon sellers needing to keep accurate financial records without the hassle of manual input. It includes automatic updates and calculations that reduce manual input time significantly. Enhanced Decision MakingAdvanced reporting capabilities are among the most valued features in premium accounting packages. Additionally, forecasting features enable sellers to plan for future growth based on current and historical sales data.

Educational Support and Customer ServiceBoth Xero and QuickBooks prioritize user education through extensive online resources including tutorials, videos, classes for certification purposes, blogs on intricate topics like inventory management or tax laws. This platform provides fundamental accounting tools such as income and expense tracking, financial reporting, and invoice creation - all at no cost. Moreover, it supports multiple currencies and tax systems, making it ideal for sellers operating in international markets. QuickBooks' US pricing starts at $35/month escalating up to $235/month depending on additional features such as inventory management or advanced reporting capabilities.

In effect this means adopting a systematic approach combined with powerful tools ensures accurate bookkeeping practices that save time and mitigate risks related to financial mismanagement for Amazon sellers.21 . Each plan varies by features such as invoicing capabilities, bill management, multi-currency support, payroll options, and more-allowing businesses to choose according to their specific requirements. Link My Books automatically imports detailed sales data from Amazon into Xero, categorizing each transaction accurately for tax purposes.

Access to community forums where users can exchange tips also enhances the overall user experience by fostering a collaborative environment for troubleshooting. Enhanced Compliance and AccuracyFor Amazon sellers operating at a high volume, regulatory compliance and tax accuracy are paramount.

For growing businesses looking to scale efficiently while managing increased transaction volumes and complex tax obligations effectively, high-quality integrated accounting solutions prove indispensable. Unleashing the Power of Cloud-Based Accounting Software for Remote TeamsStreamlining Accounting for Amazon SellersAmazon sellers face unique challenges in managing their finances, including handling complex fee structures and tax obligations.

Automated Data Importation from Amazon to XeroOne of the most significant advantages of using Link My Books with Xero is the automation of data entry. These platforms are designed to simplify the process by automatically categorizing income and expenses according to Amazon's transaction specifics. Streamlined Tax HandlingOne of the standout features of QuickBooks for Amazon sellers is its streamlined tax handling capabilities.

This is where automated solutions step in to simplify the process, ensuring compliance and accuracy in financial reporting. Customer Support FrameworkThe commitment to support is evident as both Xero offers 24/7 online help while QuickBooks provides structured assistance via phone or chat depending on your subscription plan.

Why QuickBooks Online is a Top Choice for Amazon EntrepreneursStreamlined Financial ManagementFor Amazon entrepreneurs, managing finances efficiently is crucial. Additionally, these platforms scale seamlessly with your business growth, handling increased volumes without needing proportional increases in manual work or oversight.

It encompasses enhanced efficiency through automation, strict compliance with financial regulations, reduced risk of human error, and ultimately smarter business decisions fueled by detailed analytics and reports. Revenue Tracking for Amazon Businesses In effect this means,For Amazon sellers looking at serious growth or those overwhelmed by manual accounting tasks, integrating Xero with Link My Books presents a powerful toolset tailored specifically towards managing e-commerce complexities efficiently.

These include profit margins, inventory turnover rates, and cost per acquisition. Furthermore, never underestimate the value of good customer support. 24/7 assistance from QuickBooks ensures that help is available whenever needed, making it easier to resolve issues quickly and keep your accounting tasks on track. Understanding the scale of your operations and the level of detail required for tracking can guide you in choosing between more streamlined solutions like Wave or robust systems like Xero combined with Link My Books.

Its affordability makes it an attractive option for new or smaller sellers who need essential accounting functions without a significant investment. Additionally, scalability and cost efficiency must be evaluated to ensure sustainable financial management as your business expands.

Both Xero and QuickBooks offer extensive training resources and customer support. Detailed Feature ComparisonXero offers features like easy bank matching, which automatically aligns your Amazon earnings with your bank records, VAT assistance tailored to UK tax rules, and a wide range of compatible apps. For instance, if benchmarking reveals that inventory turnover is slower than industry averages, a seller might consider strategies to enhance product visibility or adjust pricing models.

Features such as multi-currency handling, expense claims, class tracking, and advanced reporting can provide deeper insights into financial data and enhance reconciliation accuracy. The integration also simplifies the reconciliation process by matching bank deposits with sales transactions automatically.

Evaluate the pricing plans against features offered-higher costs may be justified by advanced functionalities such as multi-currency support or integrated payroll services that simplify global transactions typical for Amazon sellers operating worldwide. In effect this means,The integration of specialized accounting software allows Amazon sellers to enhance operational efficiency and accuracy while focusing on scaling their businesses. Inventory Management Systems

Key Features to Look ForWhen selecting accounting software, focus on features that cater specifically to the challenges of operating on Amazon. Additionally, consider the level of customer support provided.

This feature within Xero's accounting software significantly simplifies the process of preparing accurate VAT returns. Each element impacts how you should set up your accounting software to ensure that it is as efficient and accurate as possible. Automated Solutions: A Game ChangerIntegrating accounting software like Xero or QuickBooks with tools such as Link My Books transforms the way Amazon sellers manage their finances. This integration ensures high accuracy in bookkeeping records and simplifies financial oversight. Handling Multi-Currency TransactionsAmazon operates on a global scale, which means sellers often deal with multiple currencies.

This feature allows businesses to see their sales data as it happens, enabling immediate responses to trends or issues. This not only speeds up the accounting process but also minimizes errors associated with manual data entry. Meanwhile, QuickBooks targets users who have basic accounting knowledge offering detailed tutorials and a community forum where users can interact with peers. QuickBooks offers sophisticated analysis tools that help identify sales patterns and market trends.

Reliable support can help resolve issues quickly, minimizing downtime and ensuring continuous operation. Enhanced Accuracy and Time SavingsThe primary benefit of using automated systems like Xero combined with Link My Books is the assurance of accuracy in your financial records.

Bookkeeping, likewise referred to as accountancy, is the procedure of recording and handling information about financial entities, such as businesses and companies. Accountancy determines the outcomes of a company's financial tasks and communicates this info to a range of stakeholders, including investors, lenders, administration, and regulators. Specialists of accounting are known as accountants. The terms "audit" and "monetary coverage" are commonly utilized interchangeably. Accountancy can be separated into several fields including monetary accounting, administration accountancy, tax obligation bookkeeping and cost bookkeeping. Monetary accounting concentrates on the coverage of a company's financial information, including the prep work of monetary statements, to the external individuals of the details, such as investors, regulatory authorities and suppliers. Monitoring bookkeeping focuses on the measurement, evaluation and reporting of details for interior usage by administration to improve business procedures. The recording of monetary deals, to ensure that recaps of the financials might be presented in financial records, is referred to as accounting, of which double-entry accounting is one of the most common system. Accountancy information systems are made to support audit features and associated activities. Accounting has actually existed in various kinds and levels of refinement throughout human history. The double-entry accountancy system in operation today was established in medieval Europe, specifically in Venice, and is generally attributed to the Italian mathematician and Franciscan friar Luca Pacioli. Today, audit is assisted in by accounting companies such as standard-setters, accounting companies and professional bodies. Financial statements are generally investigated by audit companies, and are prepared based on typically accepted accountancy concepts (GAAP). GAAP is established by numerous standard-setting organizations such as the Financial Accounting Requirement Board (FASB) in the United States and the Financial Reporting Council in the United Kingdom. As of 2012, "all major economic situations" have strategies to converge towards or adopt the International Financial Coverage Criteria (IFRS).

.